We’re just in the week and 2021 is really a completely different market than last year. Several oil and gas companies increased by more than 10% as the price of WTI surpassed $ 50 a barrel. Tech stocks are underperforming the market, and investors are questioning home company valuations that are too expensive.

Like energy, the aviation and defense sectors performed well below the market performance last year. Many of the leading companies are down over 10% though Standard & Poor’s 500In excess of 15%. One of the largest pure defense contractors, Lockheed Martin (New York Stock Exchange: LMT), Was no exception and fell 9% last year.

Trading at a P / E ratio of only 15 with dividends in excess of 3%, Lockheed is shaping up to be a great value investment in 2021. This is what makes it a great buy now.

Image source: Getty Images.

Out of service sector

The Aviation and defense sector Not valid for a number of reasons. On the aviation side, the commercial aviation industry continues to struggle. Air traffic is down more than 50% from early 2020 levels, affecting commercial aircraft manufacturers such as Boeing And system and component suppliers such as Honeywell. As a pure defense contractor, Lockheed doesn’t hurt in these headwinds.

Looking ahead, the US budget can be a great resource as it predicts 10 years to pass. For fiscal year 2021, which began on October 1, 2020, projections require that $ 753 billion be earmarked for defense spending. In 2030, this number is expected to increase to 913 billion dollars. This might sound like a lot, but it’s actually only increasing by 2% per year.

Given the overall growth prospects in the short and long term, there is little argument that the defense sector is not entirely booming. Contrasting this negativity is the fact that Lockheed just investigated The highest quarterly return ever The year 2020 is expected to end with near record profits and operating cash flow. It also has a file Record accumulation in excess of $ 150 billion, Giving it a reliable source of future revenue. However, its guidelines state to increase sales by only 2% in 2021.

Growth prospects

With low growth projections in a low-growth industry, investors will likely be curious to see what the higher growth prospects for Lockheed are. The company has been investing heavily in its space sector Billions of dollars‘ worth of deals To gain greater control over the hypersonic (missile) market. With the Fiscal Year 2020 budget of $ 2.6 billion and FY2021 claim of $ 3.2 billion, the hypersonic budget is one of the fastest-growing investments on the Pentagon’s radar.

On Tuesday, Lockheed secured a $ 4.93 billion deal from the Space and Missile Systems Center at Los Angeles Air Force Base in California for three next-generation spacecraft orbiting the Earth. In addition to building the vehicles, Lockheed will provide software and support services. Contracts like these span several years and provide Lockheed a stable business from trusted clients. In particular, this contract runs through 2028. In terms of context, Lockheed generated $ 10.9 billion in sales from the space sector in 2019, representing 18% of its total consolidated net sales.

A healthy balance

Space has its horizons, but Lockheed needs to demonstrate that it can grow its top and bottom line profits during a period of heavy spending. The US government is not the only customer of Lockheed, but it made up more than 70% of 2019 sales, with US allies in Asia Pacific and Europe accounting for 10% each and the Middle East accounting for 7%. Aside from being the market leader in several major classes of defense, Lockheed’s main advantage over its competitors is its balance sheet.

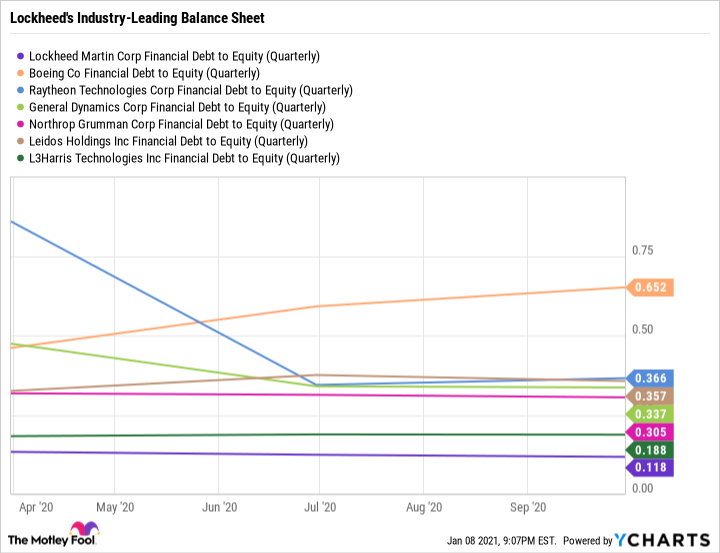

Financial Debt to Equity LMT (Quarterly) Data by YCharts

Lockheed has the lowest net debt position of less than $ 10 billion Debt-to-equity ratio From only 0.12. Its low debt and lower leverage make it able to take on more debt if needed to take advantage of growth, as well as provide a margin of safety to meet challenges.

Stable and growing yield

A strong balance sheet forms an excellent basis Distributed shares. 2021 will mark the nineteenth consecutive year in which Lockheed has raised its annual dividend. At $ 10.40 per share per year, its earnings have increased by a staggering 2,300% since 2002. Supported by lower debt, tons of Free Cash Flow (FCF) and Payout ratio Out of just 45%, Lockheed’s 3.1% dividend yield is one of the safest and most attractive Industrial inventory Stock dividends in the market today.

Universal buy now

Dividends and Value investors Both will find Lockheed’s risk / reward profile attractive. Trading with an average P / E below the market of only 15 with low debt, low leverage and stable profits, the only real downside is Lockheed’s uncertain growth rate. But with two to three years of revenue in the backlog business, the company makes up for its lack of revenue growth with reliability.

Lockheed isn’t the hottest company and it doesn’t try to be. Instead, it focuses on maintaining a good balance sheet and generating tons of FCF that can then be used to grow its profits. If this is an investment thesis you can fall behind, you may want to consider picking some stocks now.

„Organizátor. Spisovateľ. Zlý kávičkár. Evanjelista všeobecného jedla. Celoživotný fanúšik piva. Podnikateľ.“