A blatant reality of a jubilant stock market? Next week may offer the closest thing to the rookie investor estimating so far in 2021.

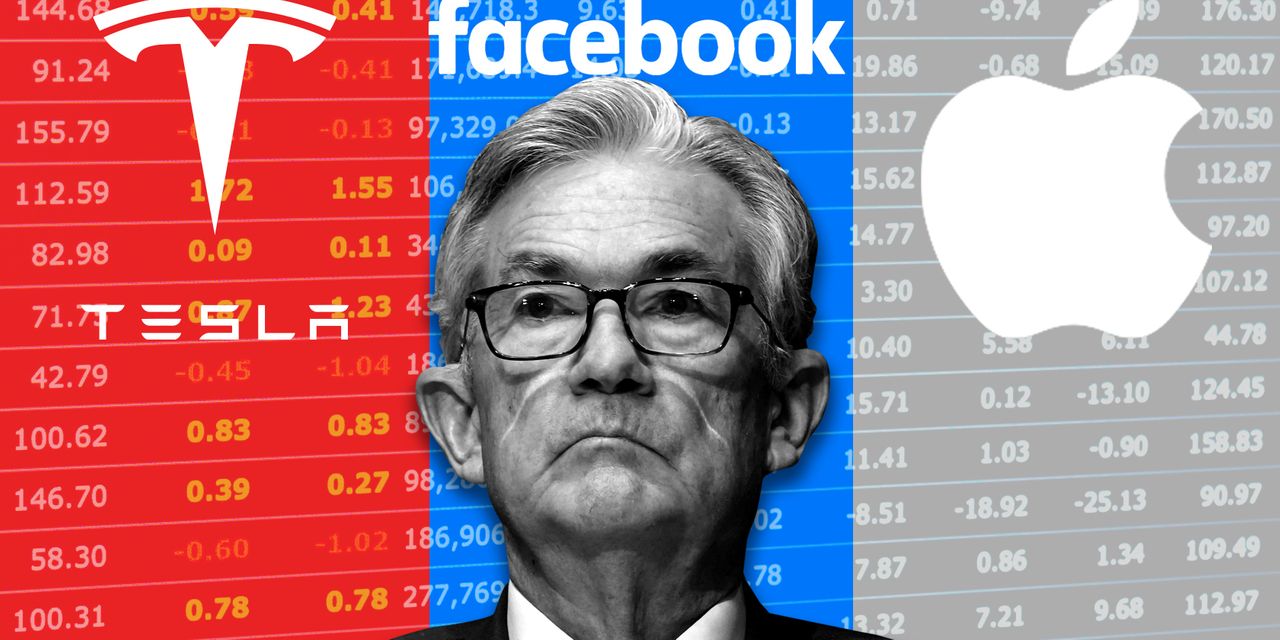

It is the busiest week of the fourth-quarter earnings season, highlighted by the highly anticipated results from heavyweight companies such as AT&T T,

Apple Inc. AAPL,

Facebook facebook,

Tesla TSLA,

In all, about 118 companies are set to announce quarterly results in the last trading week in January, including 13 components of the leading DJIA, the Dow Jones Industrial Average.

MarketWatch, John Butters, chief analyst at FactSet Research.

More than 60% of that weekly attack will start between January 27 and January 28.

The rabid period could be a pivotal stage for a market that may search for its next spark as the new administration of President Joe Biden’s administration unveils its policy initiatives and plans to tackle the COVID-19 pandemic.

So far, optimism is very high among equity investors, with sentiment data from Ned Davis Research reading 74.4%, a level it has only achieved 7.4% of the time since 1994.

Likewise, the taurus bear spread is 19.3% versus an average of 4% as of December 31, according to the American Association of Individual Investors survey.

Source: American Association of Individual Investors, Major Global Investors

Ned Davis Research says the buying sentiment appears to have crushed the appetite for bearish bets that stock prices will face a meaningful correction in the near term. „One of the things that investors have been doing the least is short selling,“ analysts Ed Clisold and Tan Nguyen wrote in a research report dated January 19.

According to the NDR data, the ratio of short selling, the number of shares short sold divided by total issues traded, reached their lowest level since 2011 in November.

One does not have to look long to find evidence of the treacherous path short sellers face these days.

for example, GameStopGME stock,

On the right path to achieving its best monthly rise in its history, up 245%, as retail investment fanatics pushed the stock and urged users on social funding-oriented platforms like Reddit to buy shares to pressure an active investor, short seller Andrew Left’s Citron pointed out research.

The actions of fanatical investor groups went beyond attempts at naming and hacking, and included what the left described as „Serious crimes such as molestation of minor childrenBarrons wrote the sister publication to MarketWatch.

For some, this is market enthusiasm at its peak. Short selling is shivering Brothers of Retail Investors They try to show their newly discovered power.

Is this how the front of the bubble feels? Are we in one? When will it appear, if so?

Federal Reserve Bank

These are all the questions that could be asked the Fed as it provides the background for the other major event of the coming week: the latest monetary policy update.

Fed Chairman Jerome Powell is often blamed for helping to prevent catastrophe in financial markets during the outbreak of the coronavirus pandemic in March last year, as well as for promoting too much risk.

The Federal Open Market Committee, headed by Powell, has rapidly lowered interest rates to nearly 0% and has pumped trillions of dollars of liquidity into the financial market rocked by COVID-19.

But some critics argue that the Fed’s policies have enhanced some of the apparent risk. The bears also prove that endless money printing will ultimately have long-term consequences for the US dollar, economy and financial markets.

Biden proposes an additional $ 1.9 trillion in federal government spending to help pull the US economy out of recession as coronavirus cases and deaths reach a new peak this month.

All of this could lend additional importance to the Fed meeting next week.

“All eyes will be on President Powell at next week’s FOMC meeting. Economists Lydia Bosor and Gregory Daco of Oxford Economics, in a research note Friday, wrote,“ We are looking to him to strike a more optimistic and cautious tone. ”

In recent speeches, Powell has already indicated that the Fed is not keen to backtrack on monetary policy alignment soon, including raising interest rates from historic lows or curtailing asset purchases, a source of support for financial markets.

The Fed meeting kicks off Tuesday, with Powell & Co. presenting its policy update on Wednesday at 2 p.m. ET, followed by a press conference hosted by the chairman.

US economic growth?

On Thursday, the day after the Fed’s decision, market participants will be waiting for the official report card on the health of the US economy.

According to consensus estimates among US economists surveyed by MarketWatch, the US economy may have grown by about 4% year-over-year in the last three months of 2020, which would normally be exceptional, but comes on the heels of a 33.4% increase in the third quarter. .

However, if the GDP reading continues to show upward progress, it may confirm that the economy is moving in the right direction even as the coronavirus pandemic continues.

After all that’s said and done if it’s the Dow and the S&P 500 SPX,

Nasdaq composite company,

Still at a spitting distance Record heights, The oxen may find themselves more daring.

„Organizátor. Spisovateľ. Zlý kávičkár. Evanjelista všeobecného jedla. Celoživotný fanúšik piva. Podnikateľ.“