Brendan McDermid / Reuters

- Virgin Galactic shares surged as much as 22% on Thursday.

- The Space Tourism Group can be added to the Ark Investment Management Space Exploration Trade Exchange Fund.

- The fund manages a total of $ 42 billion in ETF products, according to Bloomberg estimates.

- Visit Business Insider’s homepage for more stories.

The Virgo Galaxy The stock rose by as much as 22% on Thursday, boosting its market capitalization by nearly $ 1.4 billion, after a large investment fund. Reveal plans To launch an exchange fund under the heading of space.

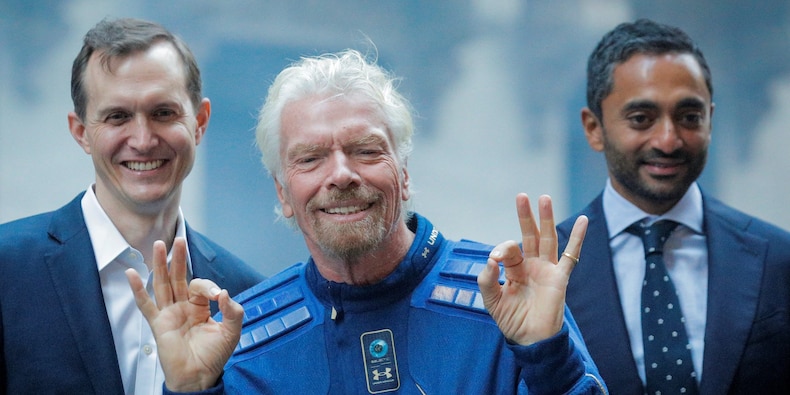

Investors in the commercial spaceflight company – co-founded by billionaire entrepreneur Richard Branson and its billionaire investor Chamath Palihapitiya – are betting on its inclusion in Ark Investment Management’s ARK Space Exploration ETF.

Ark already, led by Cathy Wood, its founder and chief investment officer, already operates seven ETFs that focus on areas such as genomics, 3D printing, robotics and fintech. Its largest subsidiary, Ark Innovation ETF, is Tesla.

Thanks to the massive influx of investor capital in recent months, Ark is now overseeing around $ 42 billion in ETF products, a sharp increase from less than $ 4 billion last year. Bloomberg Destiny.

Wood and her team plan to actively manage their ETF space. They intend to invest in domestic and foreign companies involved in space exploration and innovation and own 40 to 55 shares.

„Organizátor. Spisovateľ. Zlý kávičkár. Evanjelista všeobecného jedla. Celoživotný fanúšik piva. Podnikateľ.“